“In my opinion, most people are better off investing in the S&P 500 index. People pay huge amounts of money for advice they don’t really need.”

Warren Buffett

THE ATTRACTIVENESS OF INVESTING IN THE U.S. S&P 500

What is the S&P 500?

When we talk about the US stock market, we generally refer to the S&P which is the most representative index of the behavior of the markets of that country and the worldwide reference of the markets and investors due to its relevance.

Here we will find the possibility of investing in the shares of the best known companies such as: Facebook, Amazon, Microsoft, Google, Mastercard, Visa, Johnson & Johnson, Visa, Pepsico, Coca Cola, Walmart, McDonalds, Costco, Pfizer, ExxonMobil, among others.

The companies listed in this index are: pharmaceuticals, banks, oil companies, technology companies, banks and automakers; basically there is no part of them in all our day-to-day activities or that we make use of these companies at some point in our lives.

Having said that, it is investing in companies with global brand power and that are technically essential for human development, creating a superior attractiveness since they can generate constant and stable returns for investors around the world.

How powerful is the S&P 500?

It is estimated that, as of December 31, 2021, the existing investment of the S&P is US $15.6 trillion dollars. To put its scope in perspective, Mexico’s GDP alone at the end of 2021 (the wealth generated in our country) was US $1.273 trillion, which means that the S&P 500 is just over 12 times larger than the entire national economy.

What is the benefit of investing in the S&P 500?

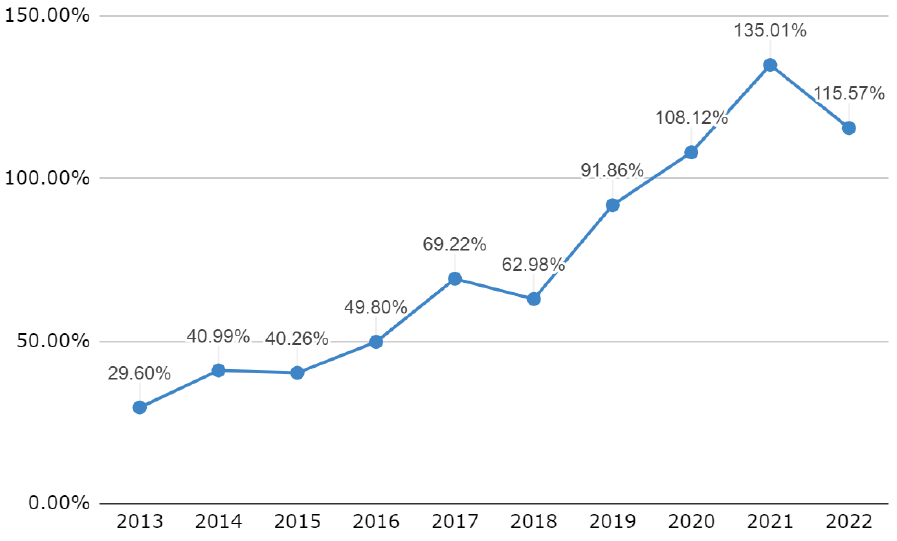

It is one of the most profitable indexes worldwide and it is usually higher in yields than any Mexican instrument such as the CETE or the Mexican Stock Exchange. Next, we will review a graph that shows its performance:

In this graph, we can observe the evolution of the S&P despite the falls. To better understand, this means that for every $100 invested I receive a return of $115 dollars, that is, more than what I initially contributed in my capital to total $228 USD.

Is it possible to invest my savings in this index?

Of course, it is possible; some years ago there was a belief that to access the stock market and Wall Street required large sums of money or that they were exclusive products for people with a sophisticated level of knowledge. It is simpler than it seems and technically any person with available savings has the availability to invest in this index with the proper advice, in which Grupo Hedeker is an active participant. The most common ways are through ETF’s and the most popular ones such as the iShares S&P 500 US, Vanguard’s VOO and Invesco S&P 500, which we have available in our investment plans.

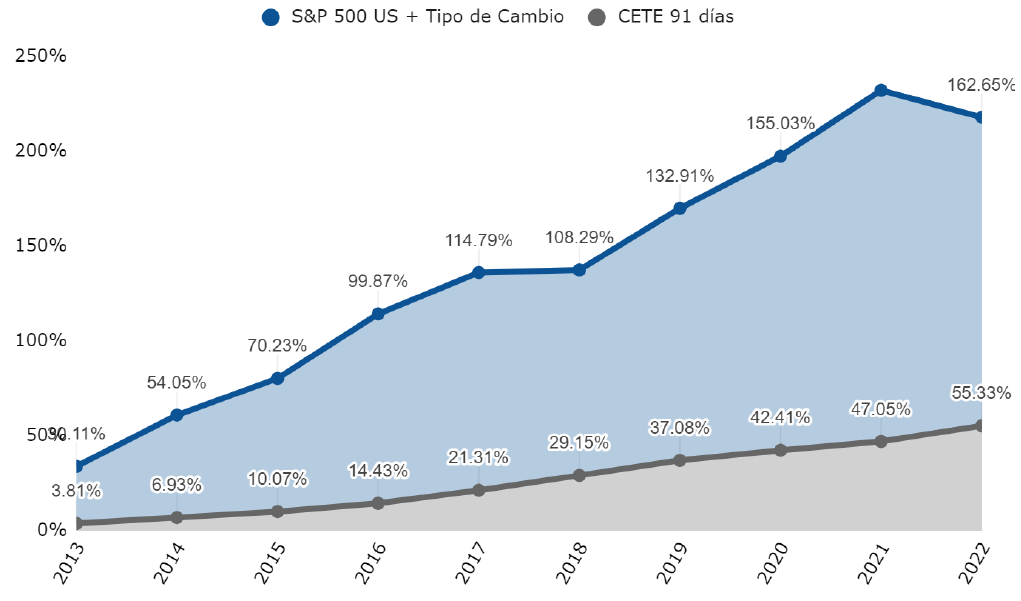

Investment comparison: CETE vs S&P 500

A reference in our investment market is the famous CETE which are government bonds with fixed interest payment and generally is the instrument with the highest fixed rate in the market, however, it does not mean that it is the most profitable investment. Let’s take a look at the comparison between the two:

The S&P 500, despite being an index that can have a variable behavior, has had an extremely superior performance than the CETE, being more than 3 times higher in yield in 10 years considering also the exchange rate of pesos per dollar and even if we eliminate the exchange rate factor, the annual average yield of the S&P is 11.55% vs. 5.53% of the CETE.