The term “blue chip” is commonly used by stockbrokers and financiers to describe a group of companies that are well-established and listed on the main indices around the world.

The term “maturity” refers to the fact that these companies are usually leaders in their business sector, they have a dominant market power, and thus they are more stable than various competitors or companies with smaller market capitalization, which generates significant interest in investing in them.

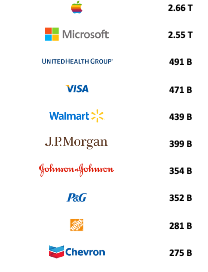

In the USA, examples can be found in companies like Coca Cola, Apple, or JP Morgan, which have been leading their respective segments for many years with a minuscule probability of failing or losing their brand value. It’s difficult to imagine our daily life without seeing a Coca Cola, an iPhone, and it would be catastrophic not to see JP Morgan as a bank.

The term “blue chip” derives from casinos, where the chip of the highest value is referred to as a “blue chip”; hence the name for the largest corporations.

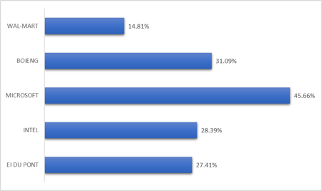

The most representative index of blue-chip companies is the Dow Jones Industrial Average because it integrates the performance of the 30 most important companies in the USA although they are not necessarily the ones with the highest market capitalization or brand value. However, they are the most relevant according to their type of commercial activity. Other representative indices include the Stoxx 50, which integrates the largest corporations in all of Europe; to combine the Eurozone and the USA, the option is the S&P 100 Global.

Why Are These Companies Attractive and Suggested Within Investment Strategies?

Stability. When investing in these companies, we see less volatility or fluctuations in their share price compared to smaller companies, so we hardly see sharp falls or rises, which generates more confidence among more conservative investors.

Dividends. Generally, these companies pay attractive dividends frequently to their shareholders, which is an interesting incentive because they generate a double profitability effect considering the buying and selling price of the shares.

Liquidity and Availability. Being high capitalization companies, renowned and of quality in their financial assets, it is relatively easy to find availability of shares when we wish to invest or withdraw from them, that is, there are always buyers and sellers in the market that allow us to move our capital easily.

What Are the Disadvantages of Investing in These?

These corporations are more limited in their expansion plans or future projects so their growth is much less exponential compared to small or medium-sized companies. This means that their shares grow to a lesser extent, so we cannot expect high short-term gains, i.e., their shares have pronounced rises in days or weeks (except for the Big Tech) and the expectation is of a gradual growth. On the flip side, when shares begin to fall, they also tend to have a slow recovery cycle, causing stagnation in investments.

Regardless of the advantages or disadvantages of investing in these companies’ shares, it is considered fundamental to include them in any equity strategy, and the weighting they should have will depend on the risk profile of each client.

For any additional topics related to economics, markets, and personal finances, contact me directly through:

Email: agarcia@hedeker.com

LinkedIn: Alberto García Medina

HEDEKER GROUP is an advisory firm specializing in international investments that aims to educate, protect, and grow the wealth of savers and investors in our country. Consult us to learn more about what we can achieve.